Ecommerce is a rapidly expanding industry, with businesses racing to offer their customers the best online shopping experience. One integral part of this experience is the payment process. The more payment options a company provides, the more likely customers are to complete their purchases. In fact, businesses that offer a variety of payment methods can potentially increase revenues by almost 30%.

To help you navigate the complex world of ecommerce payment methods, we have created this comprehensive guide, exploring everything from the basics of ecommerce to emerging payment trends.

Understanding Ecommerce

Ecommerce, or electronic commerce, is the digital platform for buying and selling goods and services. It involves a wide range of online transactions, including online shopping, electronic payments, B2B sales, software subscriptions, online auctions, and more.

Ecommerce allows businesses of all sizes to reach a global audience and operate around the clock, offering several advantages over traditional brick-and-mortar stores. These include 24/7 availability, global reach, and lower operating costs.

Ecommerce Models

There are several types of ecommerce models, including:

- Business-to-Consumer (B2C): This model involves transactions between businesses and individual consumers.

- Business-to-Business (B2B): In this model, transactions are conducted between businesses.

- Consumer-to-Consumer (C2C): This model involves transactions between individual consumers.

- Consumer-to-Business (C2B): This model involves transactions where individual consumers sell goods or services to businesses.

Ecommerce platforms require secure online payment processing, mechanisms for product selection, order fulfillment, and shipping. Many platforms also offer additional features such as customer reviews, product recommendations, and customer support.

Types of Ecommerce Payment Methods

As ecommerce continues to grow, so do the methods by which people pay for goods and services online. Offering a wide range of payment methods can help businesses accommodate their customers’ preferences and needs. Here are some of the most popular global ecommerce payment methods available today:

Credit and Debit Cards

Credit and debit cards are the most common payment methods for ecommerce transactions. They offer a quick and convenient way for customers to make payments.

Digital Wallets

Digital wallets, such as PayPal, Apple Pay, and Google Pay, have gained popularity. They securely store payment information and allow customers to make payments with just a few clicks.

Bank Transfers

Bank transfers, or electronic funds transfers (EFTs), let customers transfer money from their bank account to the merchant’s bank account. While used worldwide, they are particularly popular in Europe and Asia.

Cash on Delivery (COD)

COD is a payment method in which customers pay for their purchases upon receipt. This method is common in countries where credit and debit card usage is low.

Mobile Payments

Mobile payments allow customers to pay using their mobile devices. The use of mobile payments is growing, especially in markets with high smartphone penetration.

Buy Now, Pay Later

This payment option lets customers purchase goods or services upfront and delay payment until a later date, usually with interest or fees.

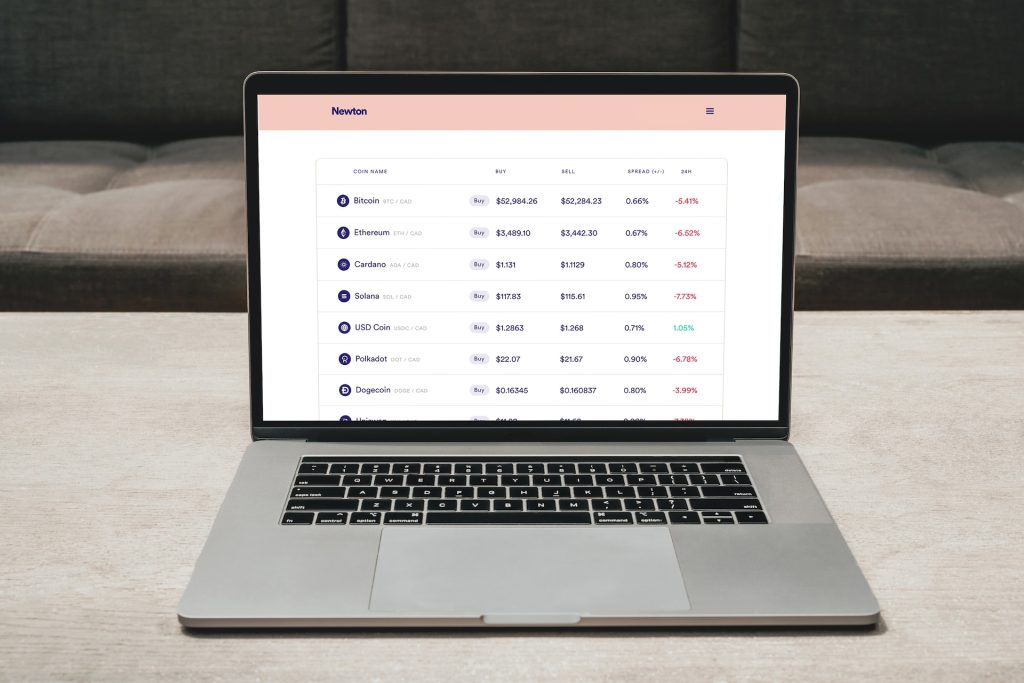

Cryptocurrency

Cryptocurrency, such as Bitcoin and Ethereum, is a digital currency that can be used to make ecommerce transactions. It is gradually gaining acceptance by online retailers.

Prepaid Cards

Prepaid cards are a type of debit card that is loaded with a specific amount of money. Customers can use them to pay for online purchases, just like they would with a regular debit card.

Deciding Which Ecommerce Payment Methods to Offer

When choosing which ecommerce payment methods to offer, businesses should consider several factors:

Customer Preferences and Market Standards

Businesses should understand how their target customers prefer to pay for goods and services and what payment methods their competitors offer.

Transaction Fees

Businesses should consider the transaction fees associated with each payment method. For instance, credit cards typically have higher transaction fees compared to other methods.

Security and Fraud Prevention

Offering secure payment methods that protect both the business and its customers from fraud is essential. Payment methods that use two-factor authentication, encryption, and fraud detection are generally a better choice.

Compatibility with Ecommerce Platform

Businesses should ensure that their payment methods are compatible with their ecommerce platform. Some payment methods may require additional integration, which can be costly and time-consuming.

Target Audience Demographics

Businesses should consider their target audience’s demographics and the payment methods popular among those groups. For instance, younger audiences may prefer digital wallets, while older audiences may prefer traditional payment methods like credit cards or bank transfers.

Geographical Location of Customers

Businesses should consider their customers’ geographical location and offer payment methods that are widely used and accepted in those areas.

The Importance of a Secure Payment Processing Experience

Understanding how ecommerce payment processing works is crucial for operating a successful online store. There are three main elements involved in payment processing:

- Payment Gateways: They act as the courier between the ecommerce website where the customer enters their payment information and the payment processor.

- Payment Processors: They take the information from the gateway, verify that the customer has the funds, and deposit the money in the merchant account.

- Merchant Accounts: They receive the funds once they are processed.

Together, these elements ensure a smooth and secure payment process. However, businesses need to ensure that their payment processors are PCI compliant, use tokenization for sensitive payment information, accept the payment methods customers prefer, and charge reasonable fees.

The Role of Ecommerce Merchant Accounts

Ecommerce merchant accounts can help businesses offer the right digital payment options for their customers. They can also help manage and reduce the fees associated with various payment gateways. These accounts use high-grade encryption when processing payments, ensuring a secure environment for customers to complete their transactions.

Examples of Ecommerce Payment Solutions

There are several payment service providers (PSPs) that offer payment processing services, gateways, and merchant accounts. Some examples include PayPal, Stripe, Square, BlueSnap, Amazon Pay, Klarna, and Sezzle. These providers offer a range of services, from accepting credit and debit card payments to offering buy now, pay later options.

Conclusion

Payment options play a crucial role in the success of an ecommerce business. By offering a variety of secure and convenient payment methods, businesses can enhance customer satisfaction, increase conversion rates, and gain a competitive edge in the ecommerce landscape.

Whether you’re just starting out or are a fully established business, understanding and implementing the right payment methods is a core component of your success. There’s no shortage of options to choose from, but it’s essential to pick a payment processor that meets your specific needs and those of your customers.