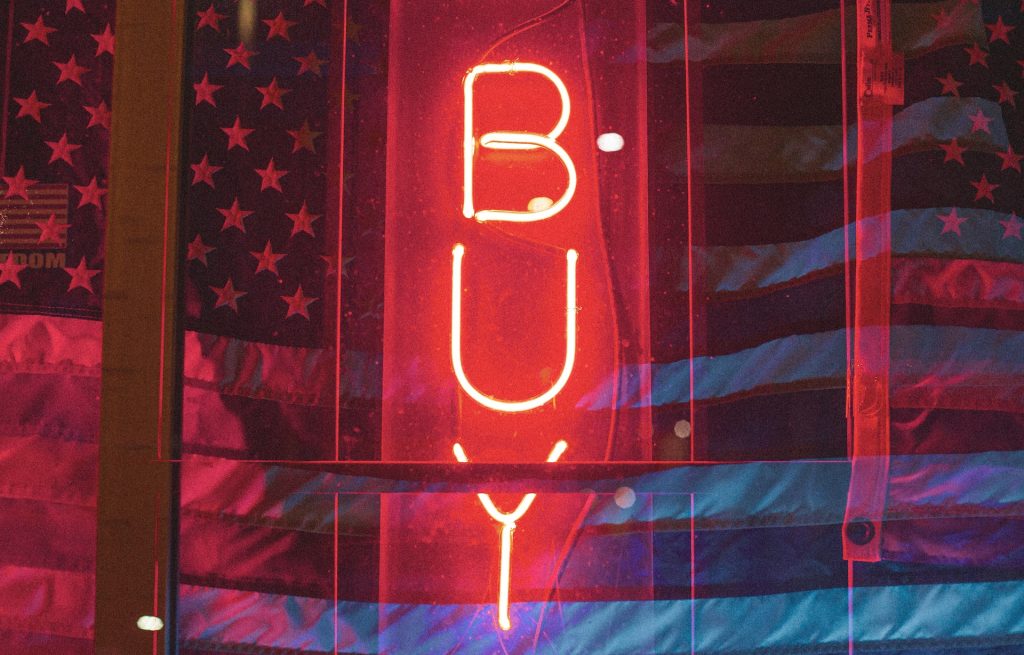

The ‘Buy Now, Pay Later’ (BNPL) financial model has seen a significant surge in popularity across Europe in recent times. With its ability to provide consumers with an easy and convenient way to finance their purchases, BNPL is transforming the e-commerce landscape. However, the industry is not without its challenges. This article explores the rise of BNPL in Europe, its potential future, and the issues it faces.

A Glimpse Into the BNPL Phenomenon

BNPL, a financial service that allows consumers to purchase goods and pay for them in installments, often without any interest, has experienced a rapid growth spurt across Europe. The convenience of BNPL has made it a preferred choice for many consumers, particularly among the younger generation, often being chosen over traditional credit cards.

The Growth and Popularity of BNPL

With the advent of e-commerce and the rise in digital spending, particularly during the pandemic, BNPL has seen a significant uptick. By 2025, it is anticipated that the BNPL industry in Europe will be worth around €300 billion, capturing approximately 11% of the European e-commerce market.

It’s important to note that while BNPL is still smaller than the credit card industry, its market trajectory indicates a growing mainstream acceptance. Joerg Diewald, the chief commercial officer of Germany-based fintech Solaris, sees BNPL expanding into essential sectors like healthcare, energy, and travel as costs rise.

Despite its popularity and growth, BNPL has faced criticisms and challenges. Some critics argue that it encourages unsustainable spending and increases reliance on debt. Moreover, rising interest rates pose another challenge, as they could lead to a higher cost of funding1.

The Players in the BNPL in Europe

Klarna, Clearpay, Scalapay, Alma, Billie, and Allegro Pay are some of the companies synonymous with BNPL. Other financial giants like MasterCard, Visa, Goldman Sachs, Apple, and PayPal have also ventured into this domain. In addition, traditional banks and fintechs like Revolut and Monzo, among others, have also introduced their own BNPL offerings.

In the BNPL landscape, Klarna is a dominant player in Europe, but other companies are also establishing their presence across the continent.

The Unique Strategies of BNPL Companies

While several BNPL providers offer similar services, each of them has its unique strategy and target market. For instance, Klarna aims to be an e-commerce platform with payments as the core of its monetization model.

On the other hand, Alma, a French BNPL startup headed by former Stripe executive Louis Chatriot, has differentiated itself by not charging late payment fees. Chatriot emphasizes that his company’s success should not come at the expense of the consumer.

BNPL and Social Responsibility

A significant point of contention in the BNPL industry is the use of these services for essential purchases like groceries or food delivery. Critics argue that promoting such usage could push struggling families into unmanageable debt.

Chatriot believes that BNPL should not be used for buying essentials like groceries or food delivery. He has expressed concerns about companies capitalizing on high margins through late payment fees, which he believes incentivizes lending to those who may struggle to repay.

Regional BNPL Players: The Case of Twisto

Twisto, a Czech banking app, has positioned itself as the “Klarna of the East”. It aims to dominate the BNPL market in the Czech Republic and Poland. Twisto’s CEO, Michal Smida, believes that their BNPL offering gives customers security in online shopping.

Smida believes that credit is somewhat taboo in Eastern and Central Europe, and as a result, BNPL is still in its early stages in these regions. He believes that local BNPL providers will have an advantage over international giants like PayPal.

The Emergence of B2B BNPL

Business-to-business (B2B) BNPL is another growing sector, with several European companies like Billie, Mondu, and Hokodo leading the way. B2B BNPL comes in various forms, including B2B marketplaces, and caters to a wide variety of businesses.

However, B2B BNPL is a more complex process than its B2C counterpart. Dealing with a broad range of businesses, credit and fraud scoring, and according credit limits to businesses make B2B BNPL a challenging domain.

Regulatory Changes in the BNPL Industry

The rapid growth and high valuations of BNPL firms, coupled with the lack of regulation, have been significant factors behind the popularity of this industry. However, changes are on the horizon, with regulation coming to the UK BNPL market and across the EU.

The Importance of Data Sharing

Sharing credit information is a hot topic within the BNPL industry. Klarna has already started sharing its repayment data with two of the UK’s biggest credit reference agencies.

Across Europe, there are calls for more data sharing, with BNPL providers urging banks and utility firms to share customer data, enabling them to make better lending decisions.

The Future of BNPL

With new entrants continually entering the market, the BNPL sector is heating up. Some experts predict consolidation among BNPL providers, with some companies potentially shutting down. They believe that two types of BNPL will emerge: one focusing on consumers, like Klarna, and the other focusing on merchants, like Alma.

However, whether BNPL will ever replace credit cards is still up for debate.

Conclusion

The BNPL industry in Europe has seen significant growth and popularity in recent years. With its convenience and flexibility, it has attracted a vast consumer base. However, the sector also faces potential regulatory changes and criticisms. Despite these challenges, the future of BNPL appears promising, with new players entering the market and existing ones constantly innovating to stay competitive.